Coronavirus Aid, Relief, and Economic Security Act:

The CARES Act

The Coronavirus Aid, Relief, and Economic Security Act or the CARES Act addresses economic impacts of, and otherwise responds to, the COVID-19 (coronavirus) outbreak.

The bill authorizes emergency loans to distressed businesses, tax rebates for individuals, special provisions for students, expands health protections and paid leave, establishes special tax provisions, and authorizes the Department of the Treasury to temporarily guarantee money-market funds. The CARES Act also funds COVID-19 related research and development while establishing new policies to help expedite getting drugs, diagnostics and medical devices to the people who need them.

Federal Resource Sites

Paycheck Protection Program Loan Application

Paycheck Protection Program FAQ's

View list of Arizona SBA Lenders

Excellent SBA Loan Options Matrix for Business created by GPEC

Tip: It is a good idea to start your outreach with banks where you an existing depository or lending relationship.

Helping People

The Coronavirus Aid, Relief, and Economic Security Act or the CARES Act

- Provides funding for $1,200 tax rebates to individual and $2,400 to joint filers. Additional $500 payments are made per qualifying child. The rebate begins phasing out when incomes exceed $75,000 (or $150,000 for joint filers). Click here to learn more and use a rebate calculator developed by the Washington Post.

-

The payments will start to phase out for Americans who earn more than $75,000, or $150,000 for a joint return. The amount you receive will be decreased by 5% of the amount your income exceeds $75,000. For example, a single person with an $85,000 salary would get $700 after subtracting 5% of $10,000, or $500.

The payments will phase out completely for single filers with incomes exceeding $99,000, $136,500 for head of household filers with one child, and $198,000 for joint filers with no children.

Note: Checks will be calculated based on your most recent annual IRS income tax filing. Please do not call the IRS looking for checks or asking how to apply. Payments will be made automatically, no application is required.

WARNING: The FBI, state attorneys general and other agencies are alerting Americans that phone calls, texts or emails asking for personal or financial information to get the $1,200 federal payment are not legitimate. Unfortunately, scammers are out there. Get information on how to avoid scammers at FTC.gov/coronavirus.

Taxes and Tax Filings:

- Establishes special rules for certain tax-favored withdrawals from retirement plans (See "Helping People" below)

- Revises other provisions, including those related to losses, charitable deductions, and business interest. (See below)

Note: If you have not filed your federal or Arizona state income taxes, the 2019 filing deadline for individuals is now July 15th.

With respect to health care, the bill helps people by (See "Healthcare" below)

- Limiting liability for volunteer health care professionals;

- Expanding health-insurance coverage for diagnostic testing and requires coverage for preventative services and vaccines;

- Revising other provisions, including those regarding the medical supply chain, the national stockpile, the health care workforce, the Healthy Start program, telehealth services, nutrition services, Medicare, and Medicaid.

With respect to Students Loans the CARES Act (See "Helping People" below)

- Temporarily suspends payments for federal student loans. Most provisions apply only to Direct Loans and Federal Family Education Loans (FFEL loans) currently owned by the U.S. Department of Education (Department). NOTE: Perkins Loans nor commercially-held FFEL loans are covered by the CARES Act. Private student loans are not covered by most of the provisions of the bill. Learn more at StudentAid.gov.

- Revises provisions related to campus-based aid, supplemental educational-opportunity grants, federal work-study, subsidized loans, Pell grants, and foreign institutions. (Learn more at SavingForCollege.com)

With respect to you and your employer, the CARES Act: (See "Employees & Employers" below)

- Establishes limits on requirements for employers to provide paid leave.

- Expands Unemployment Benefits

With respect to your savings and retirement accounts, the CARES Act: (See "Help for People" below)

- Authorizes the Department of the Treasury to temporarily guarantee money-market funds.

- Required minimum distributions (RMDs) are suspended for 2020. All RMDs are suspended, including those for inherited IRAs as well as traditional IRAs of those over age 70½. (This does not mean that you can not take your full RMD, just that you are not required to.)

- The 10% penalty for taking early distributions from qualified retirement plans, including IRAs and 401(k)s, is waived. The waiver applies to distributions taken between January 1, 2020 and December 31, 2020. Up to $100,000 of distributions can avoid the penalty.

- The mandatory 20% income tax withholding for rollover distributions is suspended for rollovers occurring between January 1, 2020 and December 31, 2020.

For additional information, reference the following article at FORBES: https://www.forbes.com/sites/bobcarlson/2020/03/28/ira-and-retirement-plan-changes-in-the-cares-act/#670b107a34f5

Unemployment Benefits

The CARES Act builds on the two former pieces of legislation by providing more robust support for unemployment benefits.

Expanded unemployment insurance (UI) for workers, including a $600 per week increase in benefits for up to four months and federal funding of UI benefits provided to those not usually eligible for UI, such as the self-employed, independent contractors, and those with limited work history. The federal government is incentivizing states to repeal any “waiting week” provisions that prevent unemployed workers from getting benefits as soon as they are laid off by fully funding the first week of UI for states that suspend such waiting periods. Additionally, the federal government will fund an additional 13 weeks of unemployment benefits through December 31, 2020 after workers have run out of state unemployment benefits. (Source: TaxFoundation.org)

Visit the Arizona Department of Economic Security website for more information on unemployment benefits.

Help for Small Business

Resources for Navigating the Process

Choose from a video guide, step-by-step written guide or contact resources at our local Arizona, SBA District Office for help with the application process. Arizona’s local SBA office can be reached at 602.745.7200, although due to high call volumes, we recommend exhausting online resources prior to calling.

City of Phoenix Video Guide

U.S. Chamber Step-by-Step Guide

Contact the SBA

P: 1-800-659-2955 (TTY: 1-800-877-8339)

E: DisasterCustomerService@sba.gov

Video instructions for EIDL Loan Applications from the City of Phoenix

Contact Your Current Bank to Start Your Paycheck Protection Loan

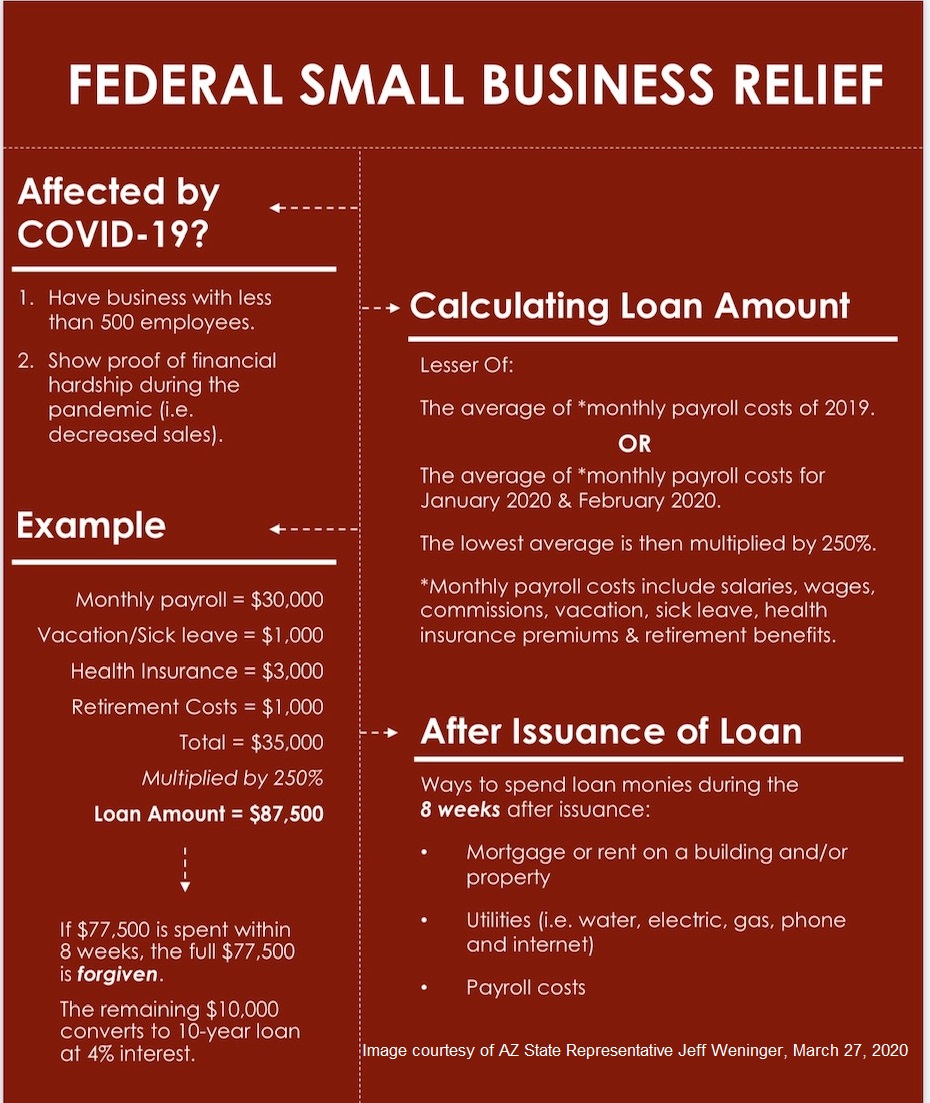

The Coronavirus Aid, Relief, and Economic Security (CARES) Act allocated $350 billion to help small businesses keep workers employed amid the pandemic and economic downturn. Known as the Paycheck Protection Program, the initiative provides 100% federally guaranteed loans to small businesses. Importantly, these loans may be forgiven if borrowers maintain their payrolls during the crisis or restore their payrolls afterward.

Jeff Weninger, a member of the Arizona House of Representatives and small business owner, prepared the graphic at right to put the numbers in perspective.

The administration soon will release more details including the list of lenders offering loans under the program. In the meantime, the U.S. Chamber of Commerce has issued this guide to help small businesses and self-employed individuals prepare to file for a loan.

This 4 page guide outlines:

- Eligibility

- What lenders will be looking for

- The amount that can be borrowed and how to calculate it

- Guidelines for Forgiveness of the loan

The Small Business Owner’s Guide to the CARES Act

The U.S. Senate Committee on Small Business has created the The Small Business Owner’s Guide to the CARES Act.

To help small business owners and entrepreneurs better understand the new programs that will soon be available to them, we have created a comprehensive guide to many of the small business provisions in the Coronavirus Aid, Relief, and Economic Security (CARES) Act that was just passed by Congress. These programs and initiatives are intended to assist business owners with whatever needs they have right now.

When implemented, there will be many new resources available for small businesses, as well as certain non-profits and other employers. This guide provides information about the major programs and initiatives that will soon be available from the Small Business Administration (SBA) to address these needs, as well as some additional tax provisions that are outside the scope of SBA.

To keep up to date on when these programs become available, please stay in contact with your local SBA District Office, which you can locate here.

Download the guide here.

Employees & Employers

Families First Coronavirus Response Act: the FFCRA

On March 18, President Donald Trump signed the Families First Coronavirus Response Act (“FFCRA” or the “Act”), taking a major step to provide paid leave to workers affected by COVID-19 and blunt the effects of the virus on the U.S. economy.

Overview: The Act contains two sections dealing with employee leave rights. Each has its own name, the Emergency Family Medical Leave Expansion Act (“EFMLEA”) and the Emergency Paid Sick Leave Act (“EPSLA”). The EFMLEA requires employers to provide 12 weeks of job-protected leave, 10 of which are paid, to workers with children affected by coronavirus-related school and daycare closures. The EPSLA requires employers to provide full-time employees with 80 hours of paid sick time, and part-time employees with a number of paid sick time hours equal to the average number of hours they worked over a two-week period in certain enumerated circumstances. Both of these laws will become effective on April 2, 2020. Learn more in this article from Snell & Wilmer

The United States Department of Labor updated its “model” notice of employees’ rights pursuant to the Families First Coronavirus Response Act (“FFCRA” or “Act”). View the Employee Rights Poster

Healthcare

With respect to healthcare, the CARES Act:

- provides additional funding for the prevention, diagnosis, and treatment of COVID-19;

- limits liability for volunteer health care professionals;

- prioritizes Food and Drug Administration (FDA) review of certain drugs;

- allows emergency use of certain diagnostic tests that are not approved by the FDA;

- expands health-insurance coverage for diagnostic testing and requires coverage for preventative services and vaccines;

- revises other provisions, including those regarding the medical supply chain, the national stockpile, the health care workforce, the Healthy Start program, telehealth services, nutrition services, Medicare, and Medicaid.

For a comprehensive breakdown of these provisions, see the article in the National Law Review.